Gadfly | April 20th, 2016

__250-wide.jpg)

Well, Folks, It’s Time To Sharpen The Pitchforks

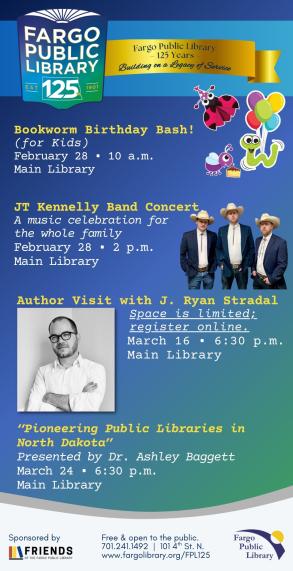

Now we really know the ultrarich in the world are very serious about keeping their money. The Panama Papers prove it. The British Virgin Islands, a tax haven in the Caribbean, has a population of 30,659 in 2016, but, amazingly, it might have over three thriving profitable shell companies hiding under the beds of each citizen of any age. It’s one of those popular tax havens filled with 113,000 shell companies incorporated there. Some whistleblower rascal stole 11.5 million files on the super-rich from a Panama law firm called Mossack Fonseca that ate up 2.6 terabytes of computer hard drive space. The stolen files in number of words equals 2,600 complete sets of the Encyclopedia Britannica. I had a set at one time. It contains millions of words. The rascal gave the stolen stuff to a German newspaper. Realizing that it would take several hundred lifetimes to read 11.5 million files and view other “stuff,” the newspaper asked for the help of 400 reporters from 80 countries to help them do the dirty work. They have had the stuff for a year, and Lord knows how long it will take to dig up every fraud and crime committed in the name of profit and loss. But the rich, powerful, famous, and infamous around the world, including 72 current or former presidents and dictators, are getting the yips about what will be revealed. Russia’s Vladimir Putin, who has been said to have as much as $40 billion stashed around the world, is prominently named in these files. This whole exercise over time may equal the famous Chinese torture called the death of a thousand cuts--which is a very slow painful death.

One of 500 firms worldwide providing financial services which include incorporating shell companies, Mossack Fonseca is the fourth largest shell company firm and employs 600 people in 42 countries in franchises that have helped create 300,000 shells. It charges a yearly fee, and operates mainly in Switzerland, Cyprus, Guernsey, Jersey, the Isle of Man, and the British Virgin Islands. So far the firm is the victim of the largest data dump in history, but claims it complies with all money-laundering laws. It also says it can’t be blamed if intermediaries, accountants, banks, and the super rich “misuse” its services. U.S. economist Gabriel Zucman estimates that 8% of the world’s wealth, or $7.6 trillion, is stashed away in thousands of tax havens around the world. In 2014 LuxLeaks estimated that multinational corporations paid almost no taxes in Europe because of shell companies incorporated in Luxembourg.

While Our Super-rich Hide Money Overseas Our College Graduates Default On Student Loans

We have hundreds of law firms and banks in this country that with lax incorporation laws will hide anything worth any bucks for you. It will cost you as little as $309 to create a shell corporation and you don’t have to reveal any secrets. A U.S. senator said it was more difficult to get a library card. Delaware, the home state of Vice-President Joe Biden, has been in the “shelter” and shell business for a hundred years, and is the “home” of 1.1 million companies. Over 95% of them are in other states or countries. Nevada and South Dakota are also in that business, but are relative pikers. Delaware makes $1 billion a year off this “financial” business, one quarter of its annual revenues. Over half of the Fortune 500 companies are registered in Delaware because of lax laws. Although the U.S. corporate tax rate is 35%, because of loopholes, tax havens, and special “accounting” tricks less than half of U.S. corporations actually pay any income taxes. The dumping of the so-called “Panama Papers” has created and revealed a financial scandal which will metastasize around the world and sharpen pitchforks in many countries. Maybe the meek will inherit something after all. Evidently the New York Times, the Washington Post, and many other important newspapers in the U.S. were not trusted to receive any of the Panama papers, but it is estimated by reliable economists that the U.S. Treasury would collect $124 billion more in taxes each year if tax havens were eliminated. Such an amount would pay the tuition for every college student in America for one year. The states are no longer funding adequately higher education. They fund football stadiums, baseball parks, and soccer fields instead.

Because the super-rich “job creators” are busy hiding their profits and assets in shell companies overseas or in the Delawares of this country instead of actually creating good jobs, 43% of the 22 million Americans saddled with student loans and out of school are behind or have received permission to postpone payments due to economic hardship. They are behind payments on $200 billion—and now the worry is they may never be able to pay. The Education Department is managing a student loan portfolio mired in $1.4 trillion debt. A Wall Street Journal report on student debt reveals that 3.6 million out-of-school Americans are in default on their loans. Many of them can’t be located! Each student borrower is sent up to 300 letters, e-mails, and text messages for notification of debt. Many have never responded at all. Half of those in default have not made a single payment! A borrower is in default if no payment has been made in a year. Defaults represent $56 billion. Three million loans are delinquent, representing $66 billion, at minimum a month behind in their payments, while three million borrowers, representing $110 billion, have received permission to postpone payments because they don’t have good jobs or enough income to make payments. Only 12.5 million out of the 22 million out of school are current on their loans. Pretty soon we will be talking real money.

The Guardian: “They Can Have Their Tax-Free Cake And Eat It”

The American brand of crony capitalism since Ronald Reagan has created the greatest inequality in the history of the modern industrialized world, with the One Percent having more wealth than the bottom 90 Percent. The public is finally realizing that the six-member Walton family of Wal Mart fame has more assets than the bottom 40 Percent. For 30 years the American sheeple have accepted the capitalistic brand with the condition that we have “social mobility,” in other words, a good shot at the American Dream. But this means we must maintain and improve the general public good; that is, access to a good education, both K-12 and higher ed, well-maintained parks, roads, bridges, airports, and adequate housing. But the cost of K-16 education, the most important element in social mobility (enabling the move from the lower class to at least the upper-middle class) has been assumed by families, not society as a whole. The cost of public education has increased by 30% just in the last five years. There is not a state in the union that has shouldered its responsibility toward pre-school, K-12, and higher education. Bloomberg estimates that college tuition has gone up over 1,200% since “trickle-down” entered our lexicon 30 years ago. The rapidly disappearing middle-class has been pissed on by trickle, with wages have virtually staying the same during that period. The One Percent has made so much money over the last 30 years they hardly know what to do with it, except they have bought enough politicians to maintain their stratospheric lifestyle.

My favorite newspaper, The English Guardian, had an essay “The 1% Hide Their money Offshore—Then Use It To Corrupt Our Democracy.” It reinforces my idea it’s time to sharpen the pitchforks: “Because at root, the Panama Papers are not about taxes. They’re not even about money. What the Panama Papers really depict is the corruption of our democracy. Following on from LuxLeaks, the Panama Papers confirm that the super-rich have effectively exited the economic system the rest of us have to live in. Thirty years of runaway incomes for those at the top, and the full armoury of expensive financial sophistication, mean they no longer play by the same rules the rest of us have to follow. Tax havens are simply one reflection of that reality. Expert Nicholas Shaxon sums it up: ‘You take your money elsewhere, to another country, in order to escape the rules and laws of the society in which you operate…in so doing, you rob your own society of cash for hospitals, schools, roads…..’ In Britain and America, the super-rich …are at one and the same time exercising economic exit and political voice. They can have their tax-free cake and eat it.”

What Could We Do With All That Hidden Tax Money?

The U.S. Treasury estimates that it would collect about $124 billion ($36 billion from individuals, $88 billion from multinational corporations) each year in additional taxes if we eliminated tax havens and other financial schemes to hide money and assets. It could be put to good use. We could pay the tuition for every college student in the U.S., eliminating student loans. We could pay for the food stamps for over 45 million Americans and have $45 billion left over for other purposes. We could pay the entire salaries for every member of the armed forces and have a few bucks left over, about $8 billion for VA programs. We could fund high-quality pre-schools for every child in the country for about $90 billion. We actually need trillions to repair our infrastructure of roads, bridges, airports, and railways, but $124 billion would be a tremendous help. Maybe we could do something about teachers’ salaries so they could afford to live in homes or apartments where they teach. In California, as an example, teachers cannot qualify for 83% of homes for sale in the state, and cannot qualify for any home for sale in San Francisco and the Silicon Valley. Teachers in Silicon Valley schools have a minimum of a two-hour commute.

We could spend this money so that our future generations could get taller. Sounds silly at first, but, when the Mayflower landed our Pilgrims were met by much taller Native Americans. Later, immigrant Americans became the tallest people in the world. Recently, northern Europeans have replaced us as the tallest. The Dutch are the tallest, being eight inches taller than they were 200 years ago. The Norwegians and the Swedes have even surpassed us now. Political scientists Jacob Hacker of Yale and Paul Pierson of USC at Berkeley have done the most recent measurements in a book about U.S. politics titled “American Amnesia.” Their premise is that our government has become so conservative that it doesn’t correct the excesses of our “free market” practices. They say that government is not just a means of redistribution of wealth or even an economic handicap. They argue that government can be a crucial source of economic growth—and physical growth. Government becomes a source of physical growth because it can force people to do things such as provide means for healthier childhoods and offer more progress through financial and medical assistance to pregnant women and infants. Some children get taller because of rules and regulations. The Dutch, by the way, have had to rewrite building codes so men don’t bash their heads on door frames. So the only way to solve the economic problem of inequality and tax havens is to have governments take corrective action. Then people around the world could stop sharpening pitchforks.

February 16th 2026

February 10th 2026

January 5th 2026

December 29th 2025

December 29th 2025

_(1)_(1)_(1)_(1)_(1)__293px-wide.jpg)

_(1)_(1)_(1)_(1)_(1)__293px-wide.jpg)

_(1)__293px-wide.png)